Some people think cryptocurrency is fake and crypto exchange platforms are not secure. They also think you can lose massive money if you intend to invest. But if we focus and think carefully, we can quickly identify the cryptocurrency industry’s growth over the last few years. It is not easy to achieve the objectives if you do not know how to invest in cryptocurrency. There are many digital currencies available out there besides Bitcoin and Altcoin. Each platform has specific pros and cons. From selecting the most suitable platform to invest your money in, you must follow some rules to succeed.

Invest in Cryptocurrency: A Complete Guide

The concept of crypto trading is sophisticated. If you have decided to dive into the enormity of cryptocurrency, you must know about blockchain, what bitcoin is, how a miner works, and the rate of the available currencies. Here, these comprehensive tips will help you to invest in cryptocurrency successfully.

1. Do Not Invest Unless You Have Enough Money

Investing in cryptocurrency is not always profitable. As the price of digital currencies fluctuates frequently, it may take longer than you expected to endure revenue. You should invest only when you have enough capital and do not need this money to maintain a healthy life.

When Bitcoin faced a flat rate in 2018, investors had to wait for several months to profit from their venture. Although you can withdraw your money by losing, keeping patience can save you from the amplitude of your loss. Never try to invest by taking a loan if you are not ready to lose.

When Bitcoin faced a flat rate in 2018, investors had to wait for several months to profit from their venture. Although you can withdraw your money by losing, keeping patience can save you from the amplitude of your loss. Never try to invest by taking a loan if you are not ready to lose.

2. Explore & Gain Enough Knowledge Before Investing Money

The concept of cryptocurrency is sophisticated and includes many aspects that are not familiar to maximum people. On the other hand, it is a new idea in many countries and has not created much impact. So gather enough knowledge, ideas, and insights into some crypto trading platforms before investing funds.

Moreover, if you don’t know how to invest in cryptocurrency, then how will you succeed? To start investing, there is no need to become a pro in this sector. But you should focus on some specific things, such as the minimum amount required to deposit, security issues, risk factors, current rates, and the need to gain a transparent approach to how things work together. It is as crucial as collecting information and documents before opening a new bank account.

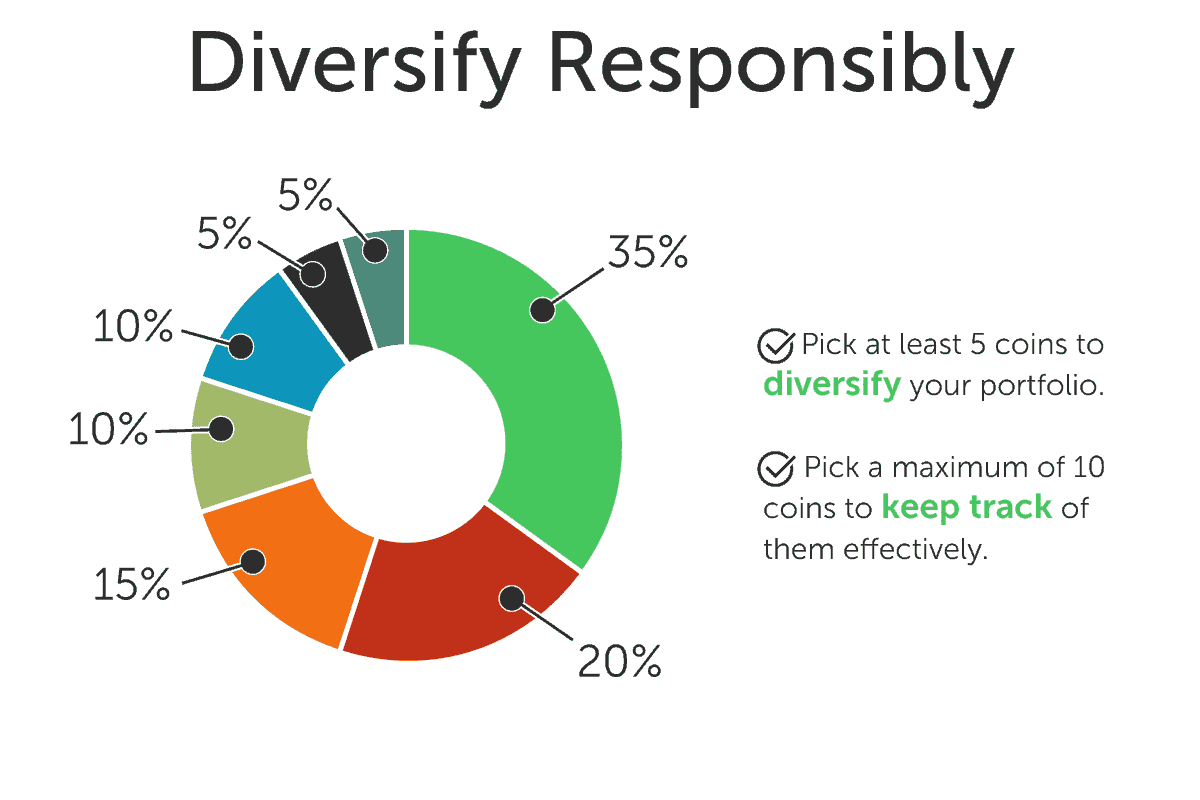

3. Find the Diversifying Opportunities

If you want to invest, try to find the opportunities and crypto industries you want to invest in. If you invest all of your free money in the same place, then the risk factor is pretty high—plan on diversifying opportunities if you do not want to incur a huge loss.

Enlighten yourself with the current rate of all the available cryptos. If you can invest money through different cryptocurrencies, it can protect you from terrible situations. Even if you experience loss on any platform, there will still be chances to turn around by making a profit from other cryptos.

4. Find Your Platform

There are many cryptocurrency exchange platforms around the world. These web platforms allow you to exchange your bitcoins with other digital assets. Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Bitcoin Cash (BCH) are the most popular cryptocurrencies.

Famous and already-established cryptocurrency platforms offer fewer features but are much more secure than the newer ones. But you can get the best rates and exclusive offers on the new platforms. Find the most suitable platform for you to start investing or buying bitcoins.

5. Conduct Your Research

Some cryptocurrencies are very successful, and there is nearly no chance of disrupting security in these projects. Most people follow popular blogs or forums before starting an investment. Explore Twitter and newspapers regularly to know the latest condition of the currencies.

Reddit is also an excellent platform for blogging and getting data from a massive crowd. Specialized discussion forums and telegrams can bring light to this matter. But naturally, you will get the most information from Google. Crossmatch all the information, evaluate the sources, and judge the authenticity as well.

6. Be Aware of Fraudulent Activities

Traditional controlling committees like central banks or stock exchanges do not regulate the platform of cryptocurrencies. Again, several security disruptions and scamming are also reported in recent years. You have to be very cautious before any unwanted situation arises.

Study some of the reported security attacks and the latest trends as well. Before investing, try to ask your consultancy firm as many questions as possible. Try to avoid unexpected high return offerings and emails, and double-check all the URLs to prevent phishing. Stick to well-known exchanges. Being self-confident and able to use common sense is also notable.

7. Find Experienced & Trustworthy People

The cryptocurrency industry has seen enormous growth in a short time, and the number of scammers has also increased rapidly. Again, if you do not have enough time to research, you must find trustworthy and experienced people to help you.

Try to differentiate between genuine and fraudulent people. If you do not have enough expertise and familiarity, take help from others. Many individuals and companies provide services to direct you in the right way to earn revenue. Do not get tempted to cheap one-time or lifetime subscriptions. Instead, follow in the footsteps of successful investors.

8. Analyze the Capitalization

If you rely only on the unit price of cryptos, you may eventually incur a loss. If you want to discover the margin of the progress of any cryptocurrency, then you will need to focus on two factors.

Understanding of market cap is required to know the exact growth of any currency. Currency with a high market cap but less growth is more potential than a low market cap.

Besides, ICO is used to know the performance of any digital currency. If the value of a project has seen a fall since its ICO, it may be identified as a scam. But again, if any crypto has already seen a lot of increment, then the chance of a further rise in that particular crypto’s value is minimal. You have to be extremely careful if you want to enter the market of cryptocurrency.

9. Track & Evaluate the Result

You have to track the record of how your investment is performing regularly. If you invest your money, three things can occur. You can lose all of your money, or the amount of cash remains stable, or you can earn a profit. Analyze the results and dig deep into the reports to extract more meaningful information.

It is not often easy to check the result because of the complexity involved in crypto trading. But thanks to developers who have built intelligent applications to track the objectives and performance.

Blockfolio and Delta are the two most dominant mobile applications that are creating a significant impact. Monitor regularly and use the features of these advanced applications to get the best result and become a successful investor.

10. Ensure the Security of Your Cryptocurrency

Traditional law enforcers do not regulate the cryptocurrency market. Besides, this industry is increasing. These reasons are responsible for all the security issues that have been highlighted in the last few years. You have to be very cautious to prevent cheaters from attacking your assets.

Never stock your currencies online; instead, use specialized wallets for storing your wealth. Physical storehouse like Ledger Nano S is also available to enhance security. Do not ever take the risk of sharing your private keys with anyone. Also, maintain and design portfolios dedicated to specific crypto. Remain focused and explore the latest issues to keep updated.

Never stock your currencies online; instead, use specialized wallets for storing your wealth. Physical storehouse like Ledger Nano S is also available to enhance security. Do not ever take the risk of sharing your private keys with anyone. Also, maintain and design portfolios dedicated to specific crypto. Remain focused and explore the latest issues to keep updated.

11. Ignore the Noise

Some people may demotivate you by saying that cryptocurrency is nothing but an overhyped topic. In many countries, this concept is not familiar. Yet almost all the companies and major banks have launched projects to expand the amount of cryptocurrency exchange worldwide.

According to recent research, the cryptocurrency exchange volume is going to rise by 50% this year. So this is undoubtedly the most suitable time to start investing in cryptos to become a successful player in this game.

Do not rely on other words and remain focused. If you decide to be an investor, avoid all noise, conduct your research, ask questions, take help from experienced persons, and collect enough resources to justify your decision.

12. Do Not Follow the Trending Groups

Many Facebook groups where so-called experienced leaders of this industry create hype by advising people on many aspects of this digital asset. You will find the shortest way to become successful, strategic suggestions, and many other lucrative issues in this group. But in most cases, the purpose is nothing but only to do their business and earn money from you.

The truth is successful investors do not have enough time to supervise you. Again the tactics that made them successful might not work for you. Prominent consultants will ask for a tremendous amount of money, and you will be disappointed ultimately. So do not fund unless you have designed your approaches and set your intentions yet.

13. Know the Risks

The technologies involved in cryptocurrency are still young, and there are many risks that you must be aware of before investing. Volatility and fraud are prominent though the significant risk is in the blockchain technology responsible for ensuring the security of digital currencies.

The rate of a cryptocurrency fluctuates frequently and can drop even up to 80% in a year. So try to know all the prices in real time. Stay away from lucrative offers, and do not just follow anyone else.

Again, you can not wholly rely on blockchain. Bugs can be identified anytime, but scammers will not wait for that day. So never invest if you are not confident and can not pressure if you lose the money somehow.

14. Know the Good Time

Many people hesitate about the ideal time to invest in cryptocurrency. The truth is there is no time that can be called the perfect time. The rate of cryptocurrency fluctuates much, and it is hard to predict a better time when you can get the highest return.

According to the statistics, February, March, and the second half of December are the prime times for investing in cryptocurrency. This is called alt time, and most of the cryptocurrencies rally at this time of year. The tax period can also be a reason behind the high rate of altcoins during these months. So try to keep yourself up to date and choose the most suitable time for you before investing.

15. Know the Market

If you want to enter into a business, you have to research and identify a market’s characteristics. It can encourage you to open new doors and new opportunities. Before investing in cryptocurrency, you must study the market condition and try to identify this industry’s future.

The cryptocurrency business is still young. If you compare this market to other financial institutions or foreign exchanges, you will recognize how small the crypto industry is. Market capitalization and trade volume suggest that there are many possibilities for the growth of cryptocurrency. So it will certainly enhance the value of the crypto market eventually.

16. Be Prepared for a Roller Coaster Ride

To shine in cryptocurrency, you must be mentally healthy and cope with any situation. You will need to be sensible enough and handle every difficulty very professionally. There is no place for those who have weak hearts.

A lot will depend on your expertise, skills, knowledge, and risk appetite, as it is a volatile market. If you can not handle the pressure of an 80% drop or (300-400)% rise, you will never be able to settle in this competitive market.

If you lose track only once, it is tough to get back on the trail again. But if you are that person who wants to make a profit rapidly, then this place is not for you. You have to keep calm and patient to roll your career smoothly.

17. Set a Target First

You must understand how to invest in bitcoin before planning to engage a lot of funds. It is a relatively new industry. As a result, predicting the right time or the correct amount invested is pretty tough. You will lose money on some trades. But you have to have a target of winning or losing to remain in the cryptocurrency market.

Many people keep investing without knowing when to push back and what the limit is. But when you lose a significant amount of money, you will probably not be able to sustain. Bitcoin’s price fluctuates rapidly and can rise up to 3% daily. So you need to set a target even before investing in a new trade.

18. Take Preparation to Handle FOMO

If you are new and do not know how to invest in cryptocurrency, it is obviously troublesome to handle the pressure. Many people can not manage the mental stress causing Fear Of Missing Out and losing all of their savings.

Never invest if you experience rapid growth, as you may miss out on the increased price of the chosen currency. If you already earn a profit, then wait for the price to drop. When the price is bottomed out, the rate of cryptocurrency will definitely go high again. Even the most experienced traders cannot track the decisive move in Bitcoin. So take, preparation to handle FOMO before investing.

19. Know the Technology

Knowing the technology and the processes involved in a project are the basics that you should cover before diving into it. So you need to investigate all the tools, technologies, and also the role of miners.

Watch youtube videos, read trustable resources, and explore the branches also. You should never stop only after knowing how to invest in cryptocurrency. If you want to be an independent and refined investor, you should also concentrate on learning algorithms like consensus and pre-mining. Besides, technology is progressing every day. So keep up with it as much as you can.

20. Understand the Implications of Tax

You can start investing only after knowing how to invest in cryptocurrency. But if you want to make your journey smooth throughout the way, you must know the process of tax implications, rules, and regulations.

Many people think we need to pay tax only if we can generate revenue over our investment. But this is not the truth. Instead, you will need to pay tax to the government for each trade you make. Keep the exchange fees and the tax implications in mind while planning your strategies.

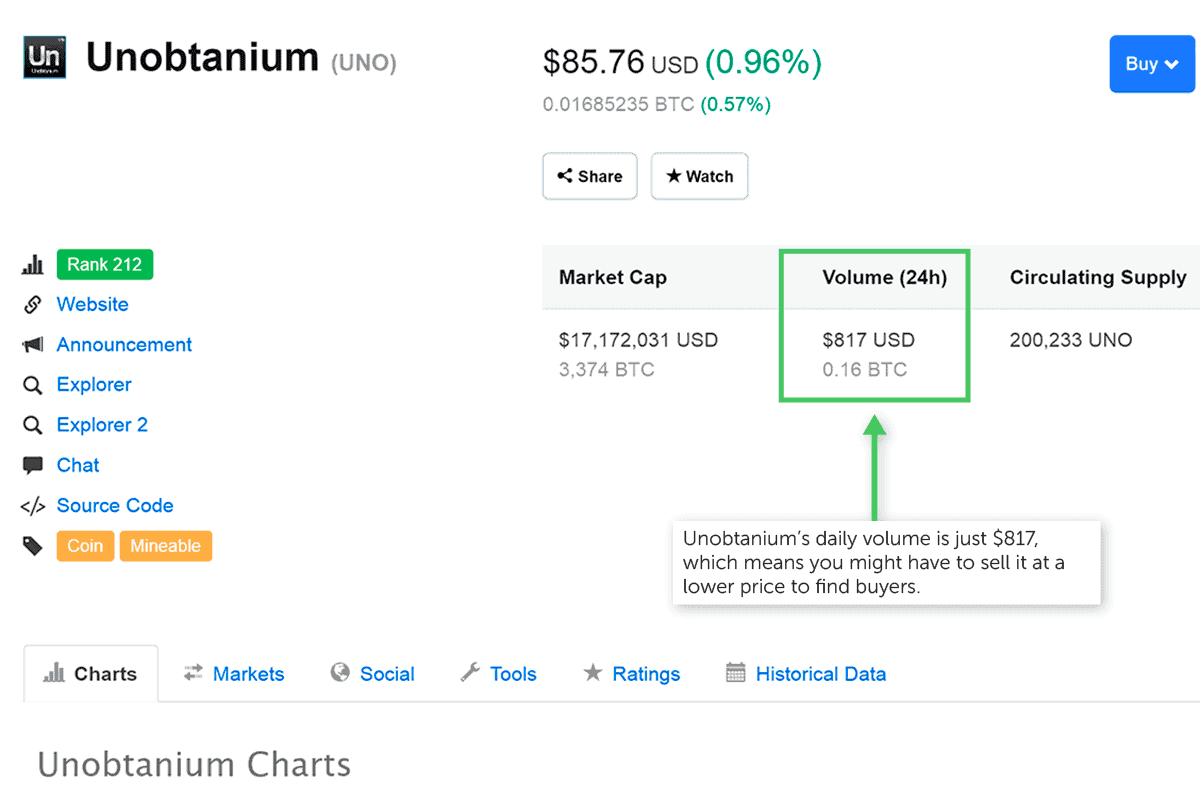

21. Enter a Liquid Market

In cryptocurrency, Liquidity refers to the ability of crypto to be converted into real money or any other digital asset. It can also be compared to a real-life scenario where you have products but do not have buyers, so your products can get sold.

Liquidity is essential for making your journey successful in the crypto market. If you ever think the price of crypto will never rise or you urgently need money, then you can sell your crypto to fulfill your requirements in no time.

But even if you have a considerable amount of the least demanding cryptocurrency, you will need to sell at a relatively low price to attract buyers. And this will ultimately cause you a lot of money.

22. Conquer the Fear, Uncertainty, and Doubt

If you already know how to invest in cryptocurrency, then this is the time you should focus on improving your mental health to conquer fear, uncertainty, and doubt. If you fall for FUD, you can miss valuable opportunities to attain success.

Some sellers try to manipulate or spread fake news when a cryptocurrency price goes as high as possible. As they want to buy that particular crypto at a lower price, they start spreading the baseless message to create confusion and uncertainty around the online communities. Try to understand their motive and do not respond to these scammers. And most importantly, do not operate on impulse.

23. Use Logic Rather Than Emotion

This is a common problem in any business. Some people love to keep faith in whatever they have done. In business, even if they keep losing, they will like to consider that his/her investment will generate some revenue one day. But it is vital to use your logic prominently to create sales or value out of the investment.

Many traders have failed to believe too much in their struggles. If you see that your crypto has been delisted from the exchanges or deleted by the team members, you should immediately take action. This market is not for you if you can not manage to sell your asset at the right time due to irrational emotional attachment. And you will end up losing all of your money.

24. Know When to Disconnect from Crypto

Knowing how to invest in cryptocurrency is never enough if you want to overcome all the problems easily that will try to haunt you to achieve your objectives. You have to be very patient and keep faith in yourself. In the crypto industry, making money quickly is rare. So you will need to wait enough time before expecting a profit.

Sometimes remaining relaxed is one of the most important things you should follow to attain your goals. After investing your money, you should do fun and take that amount for granted for losing. Do not panic; do not overthink. Do not let negativity get to you. So it is better to keep a distance from crypto for a while and take a break from all the hassles.

25. Know the Dynamics

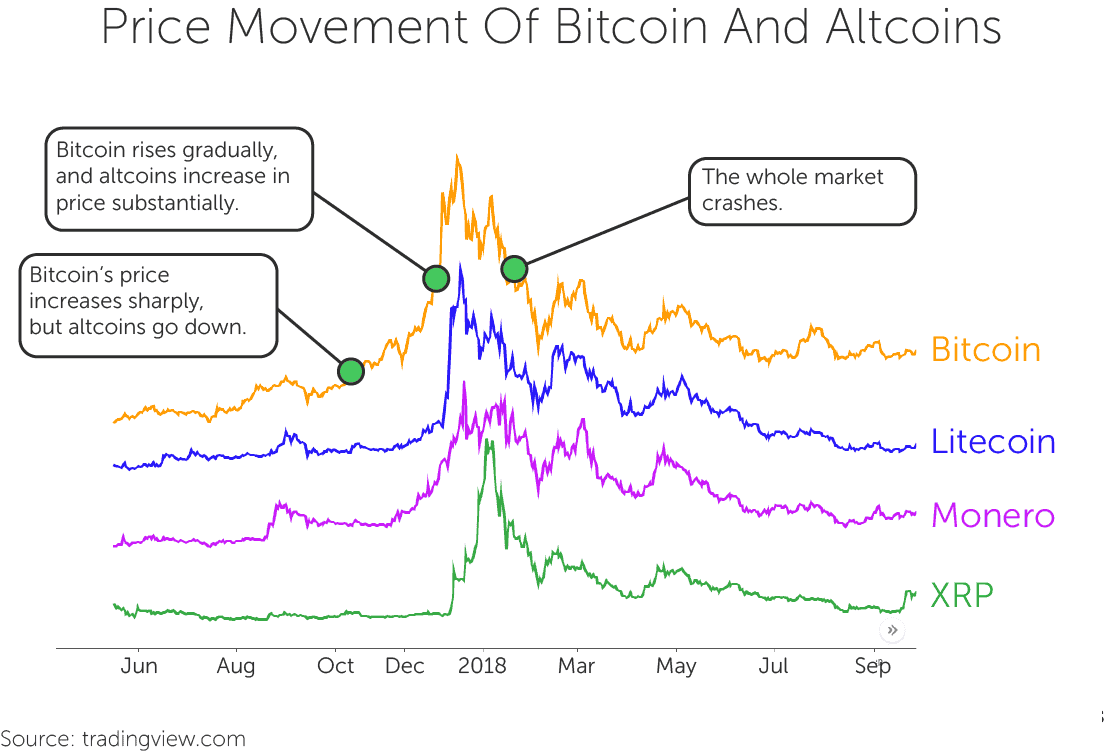

If you know how to invest in bitcoin, you must have heard that bitcoin covers almost 40%-50% of the liquid market. That means other altcoins are also profitable. You can profit from any crypto if you know the market dynamics very well.

You have to understand the correlation between bitcoins and other altcoins. While bitcoin prices increase sharply, other coins remain stable or go down. Bitcoin’s dominance in the cryptocurrency industry is also notable.

If the market crashes, the chance of a falling price is relatively lower for bitcoin than for other altcoins. Besides, bitcoin grows gradually when it comes to rising prices, and altcoin’s price depends on the price.

26. Collect the Airdrops

Sometimes you can earn money with little or no effort. But you must remain attentive and focused. If you keep yourself updated and follow all the latest news, then the chances of getting airdrops increase. Airdrops can arrange the initial money for you to invest or start your journey in this industry.

Airdrops are gifts that new companies usually provide. This is a marketing technique used by many companies to raise awareness. It is also helpful to develop brand value. But you have to go through some steps to be eligible to collect the reward.

It is as simple as submitting a multistep or straightforward form, but the reward is naturally always lucrative. If it is free and can add value, you should try to acquire it anyway.

27. Understand the Difference Between the Stock Exchange and Crypto Market

When you research how to invest in bitcoin, it is essential to know that there is a significant difference between cryptocurrency and traditional stock markets. There are so many people who make this mistake by thinking that there is the same place.

A company can introduce crypto, and you can buy it. But you will never get any dividends or hold any company position. If a company performs well, its crypto price may still fall, and you can lose money. Only security tokens can grant ownership to the traders depending on the regulating terms. So before investing, you must know the distinctions and proceed further.

28. Never Consider Yourself Lucky

You can not expect to be a successful trader only knowing how to invest in cryptocurrency. Instead, you will need some luck in this sector. Some people always love to consider themselves lucky enough and have the intention to overtrade. But this is not a dream where everything goes according to your wish.

If you look at the reports or follow some popular communities, you will see that even the most successful investors need luck. Do not overtrade, considering you are lucky. Never make sloppy mistakes. If you can 2x your investment, you can afford to lose up to 45% because you will gain in the long run. To be a great trader, you must wait for a certain period in this space.

29. Do not Over Diversify

It is advised that you should invest your money to buy multiple cryptocurrencies at a time. Rather than engaging all the money in one bucket, you should try several digital currencies simultaneously to make the most of your investment. You will incur a loss if you are a first-timer in this space.

To minimize the amount of loss, there is no alternative to investing at least ten cryptos. But never overtrade or over-diversify. Because after spending, you need to keep track of all the assets to evaluate the performance. If you fail to keep pace and lose track only once, it will be tough for you to generate revenue.

30. How to Select a Project

You already know how to invest in cryptocurrency or what you need to focus on to be a great investor. But for investing, you need to select a project first, as this is the first thing you need to be careful about before making the next step. A project with a bright future can always generate profit, while you can lose all the funds if you select a project with a relatively poor outcome.

Try to identify the missions of the project. A project with no mission is less likely to become profitable. Find out the core team members and whether they have worked together previously or not. Besides, try to know and justify the date of launching the date when the crypto will live in the market.

Wrapping Up

Cryptocurrency is going to replace traditional currencies in the coming days. It uses a strong financial security protocol for exchanging digital assets. If you want to start your journey in this space, you should start your journey immediately before this market becomes a blue ocean.

There are some commonly used rules that we have tried to focus on that you should be maintaining. To know how to invest properly in cryptocurrency, you should start from the basics and then advance for more precise information. The concept of cryptocurrency is sophisticated, and you should not proceed before clearing all the terms.

Besides, there are many things you will need to explore to dig into more detail. To be a successful trader or investor, you must visit all the branches of cryptocurrency along with their insights. Start your journey, and do not forget the advice that has been described in this article.